Medicare Advantage Plans (Part C):

All-in-One Coverage Options

Comprehensive healthcare plans that combine Original Medicare benefits with additional coverage.

What are Medicare Advantage Plans?

Medicare Advantage (MA) plans, also known as Medicare Part C, are comprehensive healthcare plans offered by private insurance companies approved by Medicare. These plans provide an alternative way to receive your Medicare benefits, combining coverage for hospital care (Part A), medical services (Part B), and often prescription drugs (Part D) into one convenient plan.

Medicare Advantage plans must cover all services that Original Medicare covers, but many offer additional benefits not covered by Original Medicare, such as dental, vision, hearing, fitness memberships, and more. These plans often include prescription drug coverage, eliminating the need for a separate Part D plan.

When you join a Medicare Advantage plan, you're still in the Medicare program, but you receive your Medicare benefits through the private insurance company rather than directly from the federal government. This integrated approach can simplify your healthcare coverage and potentially reduce your out-of-pocket costs.

Types of Medicare Advantage Plans

Medicare Advantage plans come in several different types, each with its own structure for costs and provider networks. Understanding these differences can help you choose the plan that best fits your healthcare needs and preferences.

Health Maintenance Organization (HMO) Plans

• Require you to use doctors, hospitals, and other providers in the plan's network

• Generally require a referral from your primary care physician to see a specialist

• Typically don't cover care from out-of-network providers except in emergencies

• Usually include prescription drug coverage

Preferred Provider Organization (PPO) Plans

• Allow you to see any doctor or provider, in or out of the network

• Cost less when you use doctors and hospitals in the plan's network

• Don't require referrals to see specialists

• Usually include prescription drug coverage

• Typically have higher premiums than HMO plans

Private Fee-for-Service (PFFS) Plans

• Determine how much they pay providers and how much you pay for care

• Some have networks, while others allow you to see any provider who accepts the plan's terms

• May or may not include prescription drug coverage

Special Needs Plans (SNPs)

• Designed for people with specific diseases or characteristics

• Tailor benefits, provider choices, and drug formularies to best meet the needs of the groups they serve

• Categories include plans for people with certain chronic conditions, those who live in institutions, and those who are eligible for both Medicare and Medicaid

• Always include prescription drug coverage

Medicare Medical Savings Account (MSA) Plans

• Combine a high-deductible health plan with a medical savings account

• Medicare deposits money into your account that you can use for healthcare costs

• Don't include prescription drug coverage (you'll need a separate Part D plan)

Benefits and Coverage of Medicare Advantage Plans

Medicare Advantage plans must provide all the benefits covered by Original Medicare (Parts A and B), with the exception of hospice care, which is still covered by Original Medicare even if you have a Medicare Advantage plan. Many plans offer additional benefits that Original Medicare doesn't cover.

Standard Medicare Coverage (Required)

• Hospital care (Part A)

• Medical services and supplies (Part B)

• Preventive services

• Emergency and urgent care

Additional Benefits (May vary by plan)

• Prescription drug coverage (Part D)

• Dental services (cleanings, fillings, dentures)

• Vision services (eye exams, glasses, contacts)

• Hearing services (hearing tests, hearing aids)

• Fitness benefits (gym memberships, fitness programs)

• Transportation to medical appointments

• Over-the-counter allowances

• Meal delivery after hospital stays

• Telehealth services

• Wellness programs

It's important to review each plan's specific benefits, as they can vary significantly. Some plans may offer more comprehensive coverage in certain areas than others, so consider your personal healthcare needs when comparing options.

Understanding Medicare Advantage Costs

Medicare Advantage plans have different cost structures than Original Medicare.

Understanding these costs can help you budget for your healthcare expenses and choose a plan that offers the best value for your needs.

Premium Costs

• You continue to pay your Medicare Part B premium ($174.70 in 2025)

• Many Medicare Advantage plans have an additional monthly premium, though some have $0 premiums

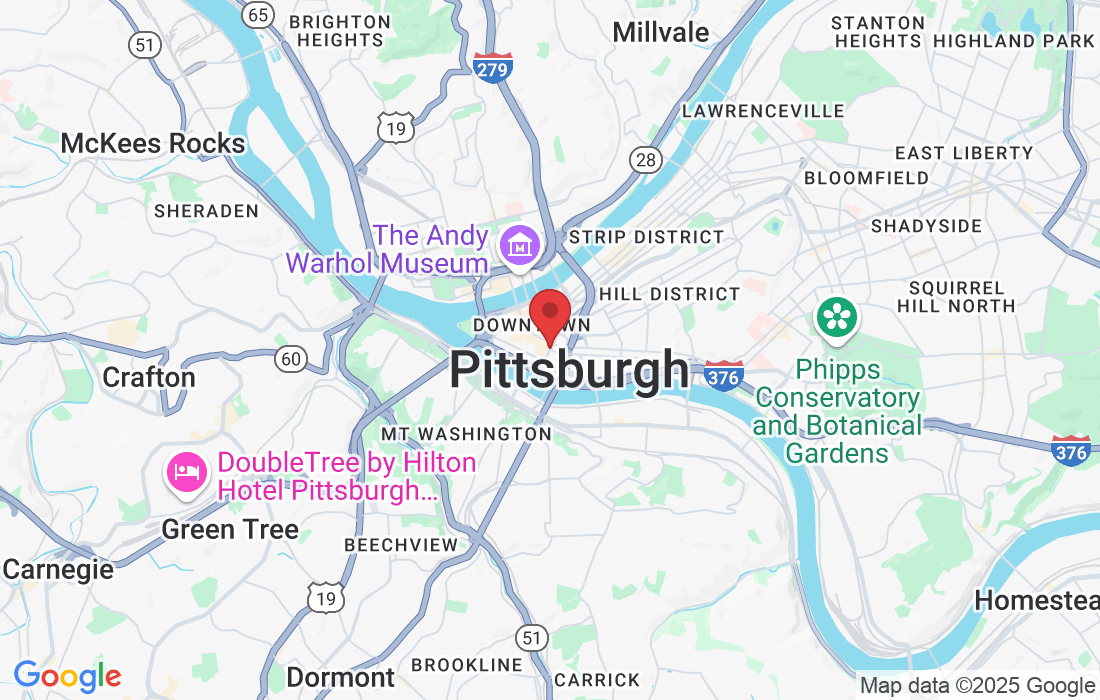

• Premium amounts vary by plan and location

Out-of-Pocket Costs

• Deductibles: Some plans have deductibles for certain services

• Copayments: Fixed amounts you pay for services (e.g., $20 for a doctor visit)

• Coinsurance: Percentage of costs you pay for services (e.g., 20% for durable medical equipment)

Out-of-Pocket Maximum

One significant benefit of Medicare Advantage plans is that they have an annual out-of-pocket maximum, which limits how much you'll have to pay for covered services in a year. Once you reach this limit, you pay nothing for covered services for the rest of the year. This provides financial protection that Original Medicare doesn't offer.

Factors Affecting Costs

• The type of plan you choose

• Whether the plan charges a monthly premium

• Whether the plan pays any of your Part B premium

• Whether the plan has a yearly deductible

• How much you pay for each visit or service (copayments or coinsurance)

• The type of healthcare services you need

• Whether you go to doctors in the plan's network

• Whether you need extra benefits and if the plan charges for them

Enrolling in a

Medicare Advantage Plan

To join a Medicare Advantage plan, you must first be enrolled in Medicare Parts A and B and live in the plan's service area. There are specific times when you can enroll in or make changes to your Medicare Advantage coverage.

Initial Enrollment Period

When you first become eligible for Medicare, you can join a Medicare Advantage plan during your Initial Enrollment Period. This is the same 7-month period when you can sign up for Original Medicare:

3 months before the month you turn 65

The month you turn 65

3 months after the month you turn 65

Annual Enrollment Period (October 15 - December 7)

During this period each year, you can:

Switch from Original Medicare to a Medicare Advantage plan

Switch from one Medicare Advantage plan to another

Switch from a Medicare Advantage plan back to Original Medicare

Medicare Advantage Open Enrollment Period (January 1 - March 31)

If you're already enrolled in a Medicare Advantage plan, during this period you can:

Switch to a different Medicare Advantage plan

Drop your Medicare Advantage plan and return to Original Medicare

Sign up for a Medicare Part D plan if you return to Original Medicare

Special Enrollment Periods

You may qualify for a Special Enrollment Period to join, switch, or drop a Medicare Advantage plan if you experience certain life events, such as:

Moving out of your plan's service area

Losing other health insurance coverage

Qualifying for Extra Help with Medicare prescription drug costs

Moving into or out of a long-term care facility

How to Choose the Right Medicare Advantage Plan

With numerous Medicare Advantage plans available, choosing the right one requires careful consideration of your healthcare needs, preferences, and budget.

Here are some factors to consider:

Provider Network

• Do your current doctors and hospitals participate in the plan?

• Are you willing to change providers if necessary?

• How important is provider choice to you?

Prescription Drug Coverage

• Does the plan include prescription drug coverage?

• Are your current medications covered in the plan's formulary?

• What are the copayments or coinsurance for your medications?

• Are there any restrictions (prior authorization, quantity limits, step therapy)?

Additional Benefits

• Which extra benefits are most important to you (dental, vision, hearing, etc.)?

• How comprehensive is the coverage for these benefits?

• Are there any limitations or restrictions?

Costs

• What is the monthly premium?

• What are the deductibles, copayments, and coinsurance?

• What is the annual out-of-pocket maximum?

• How do these costs compare to your current healthcare spending?

Star Ratings

Medicare assigns star ratings to plans based on quality and performance. Plans with higher ratings (4-5 stars) generally provide better care and service.

Plan Stability

• How long has the plan been available in your area?

• Has the plan maintained consistent benefits and costs over time?

Our licensed avalue-added consultants at C & K Healthcare Advisors can help you navigate these considerations and find a Medicare Advantage plan that aligns with your healthcare needs and budget.

©2024 Copyright

All rights reserved

Follow Us On:

Get In Touch

Assistance Hours:

Mon–Fri 8:00am – 5:00pm EST

Saturday & Sunday – By Appointment Only

Email:

[email protected]

Phone Number:

(888) 869-7270

Privacy Policy Terms & Conditions

Required Disclaimers

This is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums, and/or copayments/co-insurance may change on January 1 of each year. Medicare has neither reviewed nor endorsed this information.

C & K Healthcare Advisors is not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

By contacting us, you may be speaking with a licensed insurance agent who may sell Medicare plans on behalf of contracted insurance companies. This Website serves as an educational invitation for you, the customer, to inquire about further information regarding your health insurance options, and submission of your contact information constitutes as permission for a Licensed Insurance Representative to contact you with further information, including complete details on cost and coverage of this insurance. Contact will be made by a licensed insurance agent/producer or insurance company. This is a solicitation for Insurance .C & K Healthcare Advisors, LLC and their agents are licensed and certified representatives of a Health and Life Insurance organization. Enrollment in any plan depends on contract renewal.

Nothing on this website should ever be used as a substitute for professional medical advice.

Facebook

Instagram

Youtube

TikTok