Medicare Supplement Insurance (Medigap):

Fill the Gaps in Original Medicare

Additional coverage to help pay for costs that Original Medicare doesn't cover.

What is Medicare Supplement Insurance (Medigap)?

Medicare Supplement Insurance, also known as Medigap, is private health insurance specifically designed to supplement Original Medicare. These policies help pay for some of the healthcare costs that Original Medicare doesn't cover, such as copayments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when traveling outside the U.S.

If you have Original Medicare and purchase a Medigap policy, Medicare will pay its share of the Medicare-approved amounts for covered healthcare costs first. Then, your Medigap policy pays its share. This combination can significantly reduce your out-of-pocket expenses and provide more predictable healthcare costs.

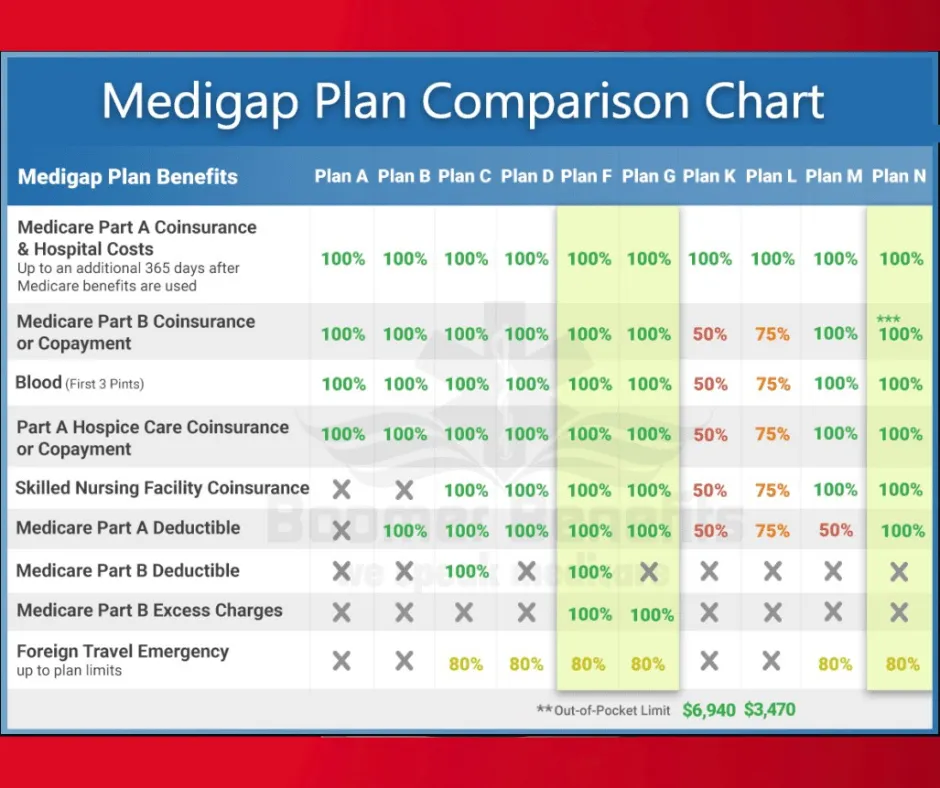

Medigap policies are sold by private insurance companies and are standardized. In most states, there are up to 10 standardized plans, each labeled with a letter (A, B, C, D, F, G, K, L, M, and N). Each standardized plan must offer the same basic benefits regardless of which insurance company sells it, though costs may vary between companies.

It's important to note that Medigap policies only work with Original Medicare. They cannot be used with Medicare Advantage Plans or other types of health coverage.

Understanding Medigap Plans

In most states, there are up to 10 standardized Medigap plans available, each identified by a letter. Each plan offers a different combination of benefits, allowing you to choose the coverage that best meets your needs.

Standardized Medigap Plans

The chart below shows basic information about the different benefits that Medigap plans cover. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you're responsible for the rest.

Note: Plans C and F are not available to people who became eligible for Medicare on or after January 1, 2020.

*Plan G also offers a high-deductible option in some states.

**Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don't result in inpatient admission.

Most Popular Medigap Plans

While there are several Medigap plans available, some are more popular than others due to their comprehensive coverage and value:

Plan G: Offers comprehensive coverage, including Part B excess charges and foreign travel emergency care. It covers everything that Plan F covers except for the Part B deductible.

Plan N: Offers similar benefits to Plan G but with lower premiums. You pay copayments for some office visits and emergency room visits, and it doesn't cover Part B excess charges.

Our licensed value-added consultants can help you understand the differences between these plans and determine which one best meets your needs and budget.

Enrolling in a Medigap Policy

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This period provides important protections that may not be available if you try to buy a policy later.

Medigap Open Enrollment Period

Your Medigap Open Enrollment Period is a 6-month period that begins the first month you have Medicare Part B and are 65 or older. During this period:

• You have a guaranteed right to buy any Medigap policy sold in your state, regardless of your health status.

• Insurance companies cannot deny you coverage or charge you more based on pre-existing health conditions.

• Insurance companies must sell you a policy at the best available rate.

Buying Outside Open Enrollment

If you try to buy a Medigap policy outside your Open Enrollment Period, insurance companies can:

• Deny you coverage based on your health status

• Charge you higher premiums based on your health status

• Impose a waiting period for coverage of pre-existing conditions

Guaranteed Issue Rights

In certain situations, you may have guaranteed issue rights (also called "Medigap protections") outside your Open Enrollment Period. These are times when insurance companies must sell you a Medigap policy, must cover all your pre-existing conditions, and cannot charge you more because of past or present health problems.

Some situations that may qualify for guaranteed issue rights include:

• You're in a Medicare Advantage Plan, and your plan is leaving Medicare or stops serving your area.

• You move out of your Medicare Advantage Plan's service area.

• You have Original Medicare and an employer group health plan that's ending.

• You have Original Medicare and a Medicare SELECT policy, and you move out of the Medicare SELECT policy's service area.

• You joined a Medicare Advantage Plan when you were first eligible for Medicare Part A at 65, and within the first year, you decide to switch back to Original Medicare.

Understanding Medigap Costs

The cost of Medigap policies can vary widely based on several factors. Understanding these costs can help you budget for your healthcare expenses and choose a policy that offers the best value for your needs.

Premium Costs

Medigap policies require a monthly premium that you pay to the private insurance company. This is in addition to your Part B premium that you pay to Medicare.

Premiums can vary based on:

• The plan you choose: More comprehensive plans generally have higher premiums.

• The insurance company: Different companies may charge different premiums for the exact same plan.

• Your location: Premiums can vary by state and even by zip code.

• Your age: Depending on the pricing method, your age may affect your premium.

Pricing Methods

Insurance companies can price (or "rate") their Medigap policies in three ways:

1.Community-rated (also called "no-age-rated"): The same premium is charged to everyone who has the policy, regardless of age. Premiums may increase due to inflation but not because of your age.

2.Issue-age-rated (also called "entry-age-rated"): The premium is based on your age when you buy the policy. Premiums are lower for people who buy at a younger age and won't increase as you age. They may increase due to inflation.

3.Attained-age-rated: The premium is based on your current age, so it increases as you get older. Premiums may also increase due to inflation. These policies may start with lower premiums but can become more expensive over time.

Additional Costs

While Medigap helps cover many out-of-pocket costs, there are still some expenses you'll be responsible for:

• Medicare Part B premium•Medicare Part B deductible

• Prescription drug costs (Medigap doesn't cover prescription drugs; you'll need a separate Part D plan)

• Services not covered by Medicare or your Medigap policy

Medigap vs. Medicare Advantage: Understanding Your Options

When considering your Medicare coverage options, you may be deciding between a Medigap policy with Original Medicare or a Medicare Advantage plan. Each option has its own advantages and considerations.

Medigap with Original Medicare

Advantages:

• Freedom to see any doctor or hospital that accepts Medicare, without referrals

• Nationwide coverage

• Predictable out-of-pocket costs

• No network restrictions

• Policies are standardized, making comparison easier

Considerations:

• Requires separate Part D plan for prescription drug coverage

• Generally higher monthly premiums

• No additional benefits like dental, vision, or hearing

• Best to enroll during your Medigap Open Enrollment Period

Medicare Advantage

Advantages:

• Often includes prescription drug coverage

• May offer additional benefits like dental, vision, and hearing

• May have lower monthly premiums

• Annual out-of-pocket maximum for covered services

Considerations:

• Usually limited to network providers

• May require referrals for specialists

• Coverage typically limited to service area

• Benefits and costs can change annually

• Cannot be used with Medigap

Our licensed value-added consultants can help you compare these options based on your specific healthcare needs, preferences, and budget.

©2024 Copyright

All rights reserved

Follow Us On:

Get In Touch

Assistance Hours:

Mon–Fri 8:00am – 5:00pm EST

Saturday & Sunday – By Appointment Only

Email:

[email protected]

Phone Number:

(888) 869-7270

Privacy Policy Terms & Conditions

Required Disclaimers

This is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums, and/or copayments/co-insurance may change on January 1 of each year. Medicare has neither reviewed nor endorsed this information.

C & K Healthcare Advisors is not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

By contacting us, you may be speaking with a licensed insurance agent who may sell Medicare plans on behalf of contracted insurance companies. This Website serves as an educational invitation for you, the customer, to inquire about further information regarding your health insurance options, and submission of your contact information constitutes as permission for a Licensed Insurance Representative to contact you with further information, including complete details on cost and coverage of this insurance. Contact will be made by a licensed insurance agent/producer or insurance company. This is a solicitation for Insurance .C & K Healthcare Advisors, LLC and their agents are licensed and certified representatives of a Health and Life Insurance organization. Enrollment in any plan depends on contract renewal.

Nothing on this website should ever be used as a substitute for professional medical advice.

Facebook

Instagram

Youtube

TikTok